Study of Best Practices for Implementing Multiple Pension Systems

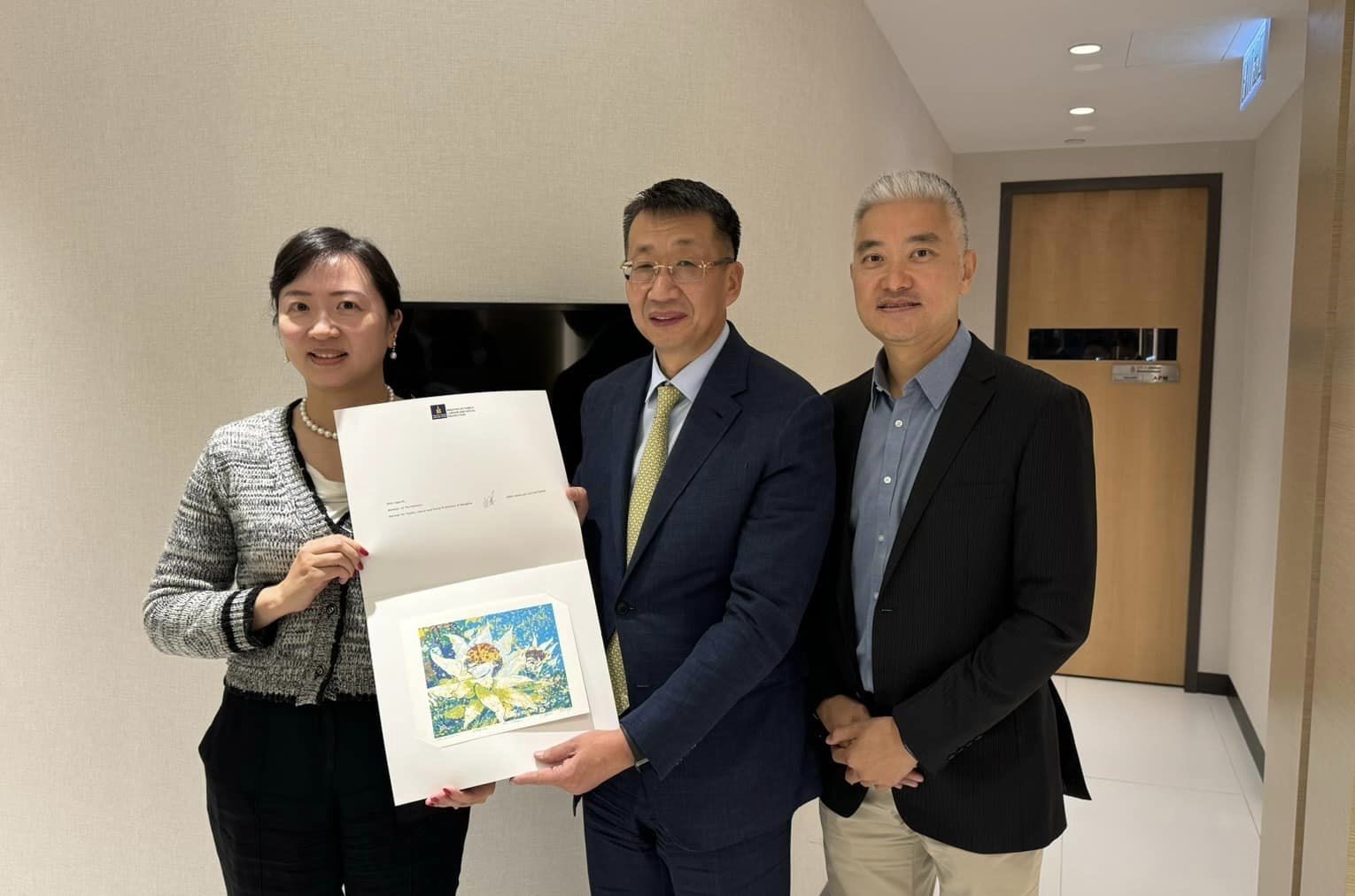

The Minister for Family, Labour and Social

Protection, L. Enkh-Amgalan,

is currently attending the “Global

Pension, Social Security, and Sovereign Wealth Funds Forum” in Hong Kong, where the focus is on pension systems, social protection, and sovereign wealth management.

During the forum, Minister

Enkh-Amgalan met with Janet Li,

the head of the Hong Kong Pension

Schemes Association, to discuss the unique features of Hong Kong’s pension system.

Key

Features of Hong Kong’s Pension System:

•

Multiple Pension Schemes: Hong

Kong offers 24 different pension

schemes, allowing both employers and employees to choose the scheme

that best suits their needs. This flexibility enables individuals to propose

their preferred pension schemes, creating a comprehensive pension plan that combines contributions from

both parties.

•

Shared Contributions: The official pension fund contributions

are shared equally between the employee (5%)

and the employer (5%).

•

Digitization in 2025: Hong Kong

is set to fully digitize its

pension system in 2025,

enhancing its efficiency and accessibility.

Minister L. Enkh-Amgalan

expressed a strong interest in studying the flexibility of Hong Kong’s system to see how it can be

adapted to Mongolia. This includes considering

the introduction of private

pension systems, providing Mongolian citizens with more retirement options and enhanced security, to create a

more diversified pension system in

Mongolia, rather than relying solely on a single pension model.